November 2020 Warm Weather Forecast

Captain's Log

Happy Monday! Only 34 days until Winter and 39 days until Christmas! :)

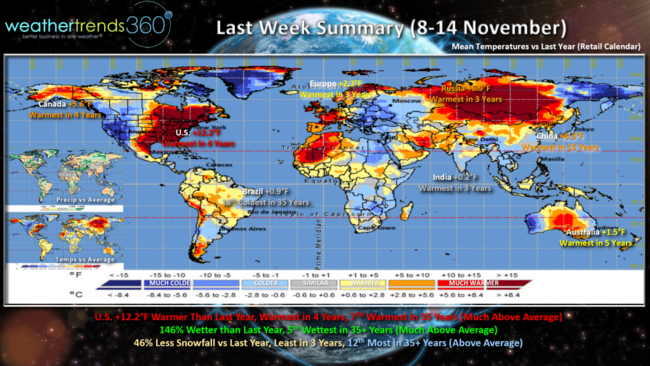

A recap of last week (8-14 Nov) around the world on a retail weekending Saturday calendar, shows most areas of the world are trending warmer than last year with the U.S. having the greatest change trending 12.2F warmer. CLICK ON IMAGES FOR A LARGER VIEW.

The Western U.S. was the cold spot while the East was basking in near record warm weather. Rainfall was 146% more than last year, 5th wettest in 35 years, while snowfall was the least in 3 years and down 46% YOY.

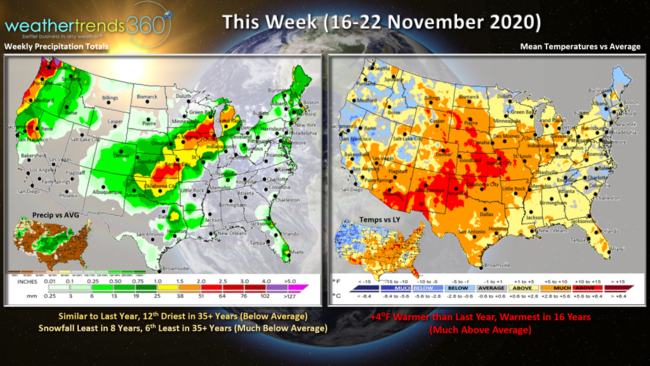

This week (16-22 Nov) across the U.S. shows a few days of cooler weather in the East but then another nationwide warmup with the U.S. trending 4F warmer than last year, warmest in 16 years. Rainfall and snowfall are both down dramatically from a year ago.

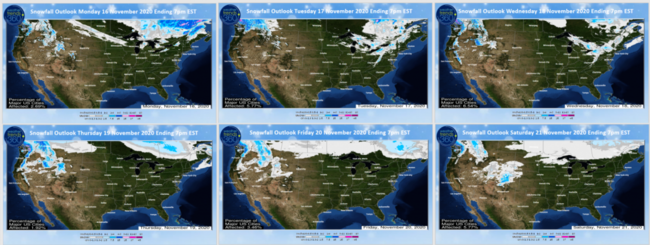

The 6-day snowfall outlook (16-21 November) shows some Lake Effect snows in the Great Lakes and Northeast but not much. By the weekend the East will be back up in the upper 50s and 60s with much above average temperatures.

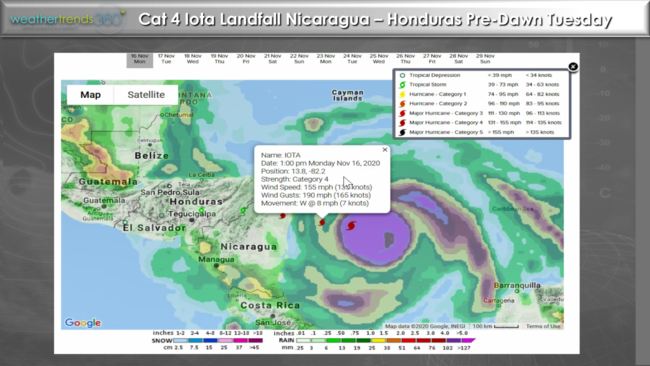

Sadly another catastrophic hurricane is headed for Honduras-Nicaragua tonight with Cat 4 Iota likely to decimate the area with winds and more extreme flooding in this high terrain topography. Prayers for everyone in Iota's path.

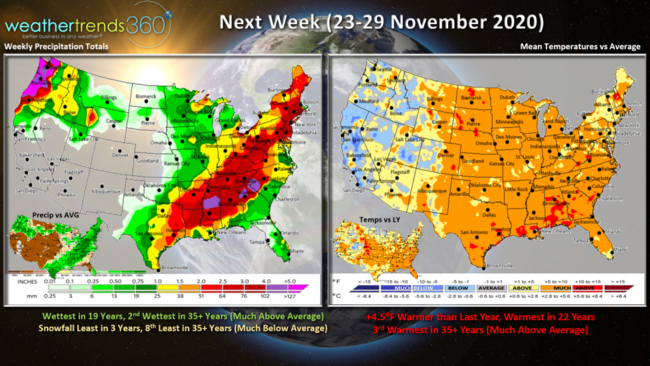

Next week (23-29 Nov) looks like coast-to-coast warm weather for the U.S. with the country trending 4.5F warmer than a year ago and warmest in 22 years. Rainfall the wettest in 19 years while snowfall remains well below average and least in 3 years. This exceptionally warm November is a negative for mounting cold/snow seasonal merchandise that will lead to steeper markdowns to keep inventory moving. Not what retailers needed after so many hurdles in 2020.

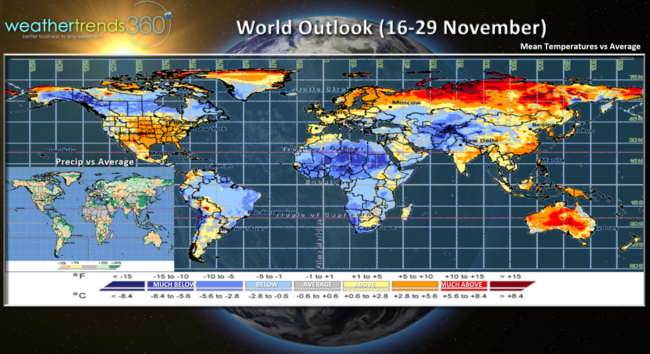

Next week (23-29 Nov) looks like coast-to-coast warm weather for the U.S. with the country trending 4.5F warmer than a year ago and warmest in 22 years. Rainfall the wettest in 19 years while snowfall remains well below average and least in 3 years. This exceptionally warm November is a negative for mounting cold/snow seasonal merchandise that will lead to steeper markdowns to keep inventory moving. Not what retailers needed after so many hurdles in 2020. The 2-week world outlook (16-29 Nov) shows the warm weather in the U.S. with the cold weather bottled up in Canada. Africa, Brazil and the Middle East are the cooler than average spots while Europe and Russia-Siberia remain warm.

The 2-week world outlook (16-29 Nov) shows the warm weather in the U.S. with the cold weather bottled up in Canada. Africa, Brazil and the Middle East are the cooler than average spots while Europe and Russia-Siberia remain warm.

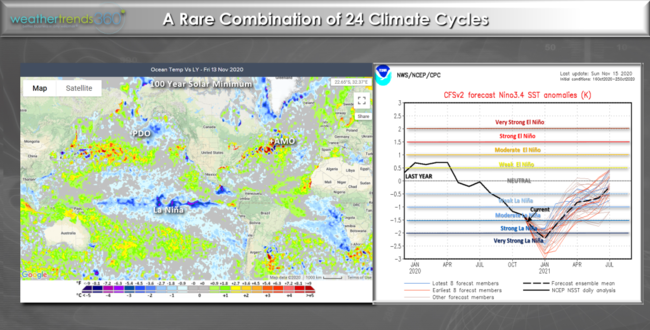

La Niña is now approaching very strong status with rapidly cooling equatorial Pacific Ocean temperatures. Combined with other long-term cycles like the -PDO, +AMO and weakest sun in nearly 100 years, the cycles scream mild Winter ahead, maybe a tad cooler than last year with snowfall up a bit nationally but still well below average. The one wintry spot likely to be the Northwest quarter of the country.

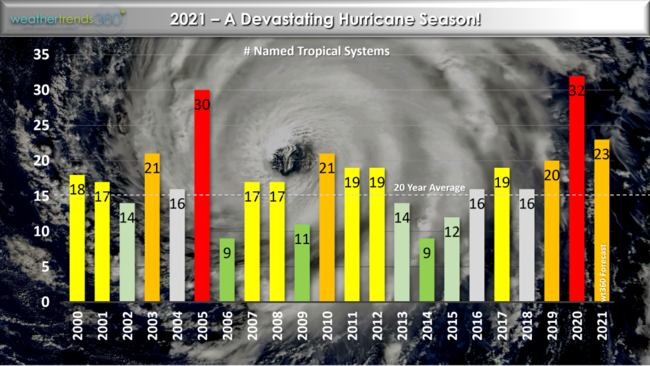

Today we'll share some of these insights with our large financial services client J.P. Morgan to include our very early 2021 Hurricane season outlook for next year suggesting another very active and even more devastating season!

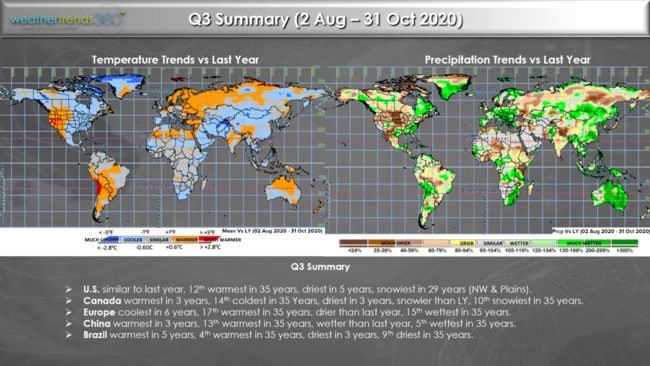

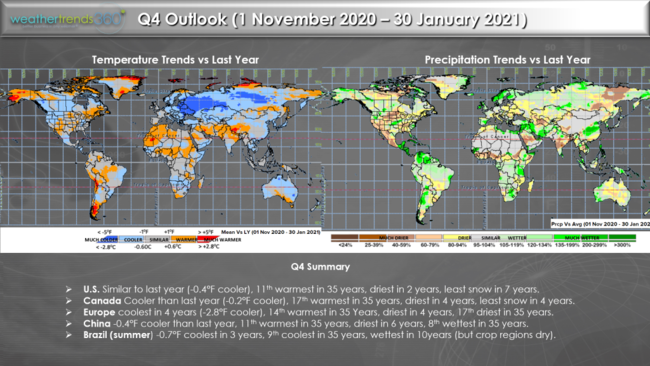

We always share a recap of the past quarter and the quarter ahead. Q3 (Aug-Oct) was a bit more favorable for Back2School in the U.S. due in large part to the coolest September in 8 years. Otherwise not a huge benefit to most.

Q4 (Nov - Jan) shows some opportunity in the NW U.S., Europe and Russia for Winter seasonal merchandise.

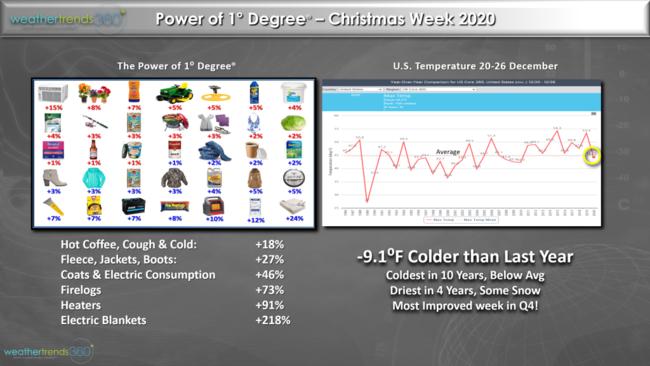

A potential bright spot in Q4 will be the week of Christmas with temperatures expected to tend 9.1F colder than last year in the U.S. which will bring a pent up demand surge in sales just in time! There will certainly be a lot of excess inventory and steeper markdowns going into the holiday shopping season, so this is some good news. Quantifying this significant drop in temperatures with our Power of 1 Degree sales forecasting technology, we expect sizeable gains for items slow to move here in November!

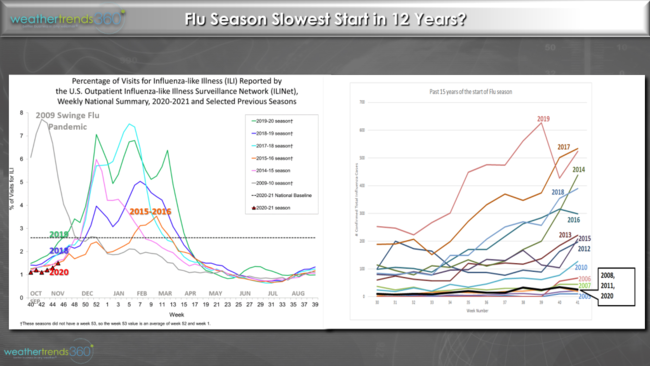

And the last bit of good news should be the U.S. Flu season which is off to a much slower start than recent years. We expect this trend to continue in light of the very weak season across the Southern Hemisphere (during their Winter - our Summer) and COVID measures in place. Kids simply are getting sick at the normal pace for many reason this year. Unlike COVID, Flu is typically spread by kids going Back2School as the weather gets colder, less humid and lower UV levels. So far so good!

Have a great week and don't forget to follow us on social media for frequent updates: Facebook, Twitter, YouTube, Pinterest and Linkedin

- Captain Kirk out.