25 Oct '25 wt360 Captain Kirk Weather Brief - Exceptional End to Q3 and Q4 Start

Captain's Log

25 Oct 2025: Happy Saturday! :)

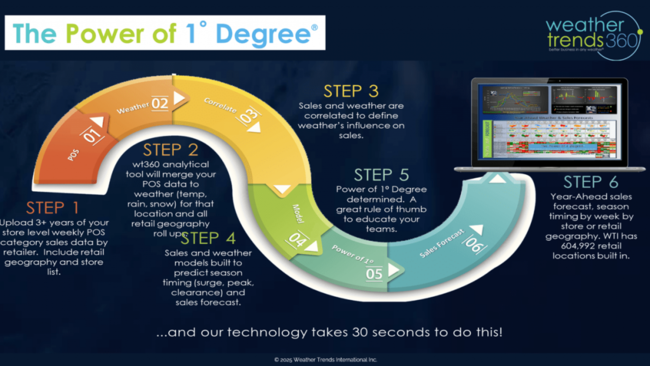

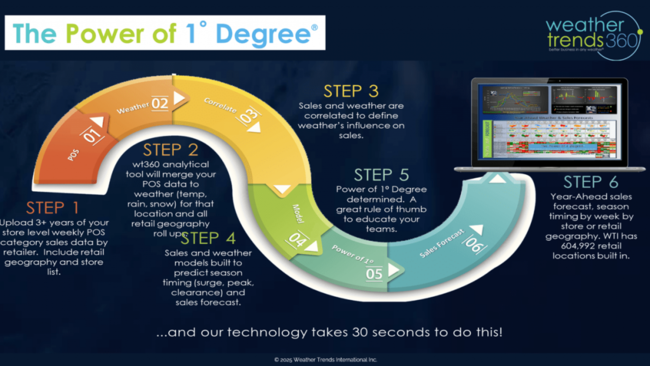

Today let's use the end of Q3 as an example of how our YEAR-AHEAD Power of 1 Degree technology predicts seasonal category sales trends, store traffic, equities and much more. CLICK ON IMAGES FOR A LARGER VIEW.

The process starts by ingesting Point-of-Sale (POS) data by store back several years, builds a correlation model to temperature, rainfall and snowfall to then project those sales out a year by week by store by warehouse anywhere in the World.

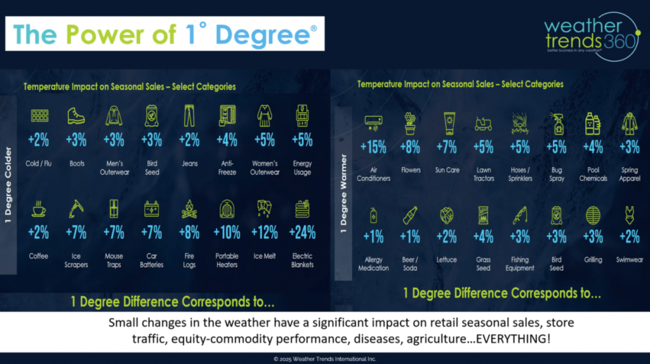

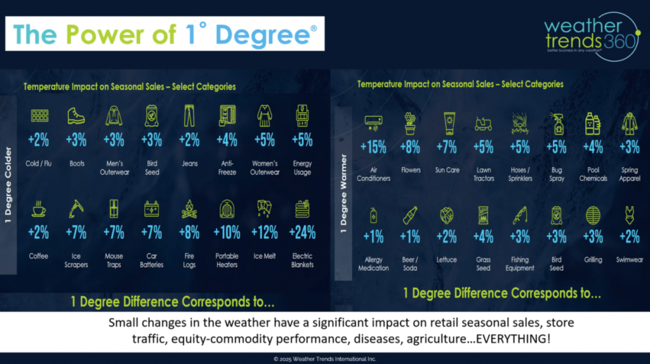

Small changes in weather have a significant influence on seasonal sales and consumer buying behavior. Every 1F colder year-over-year, there's a +2% increase in coffee sales, +5% in apparel sales, +7% in mouse trap sales and +10% in portable heater sales. 10F colder YOY the gains are double digits, Coffee +20%, Heaters +100%. LEARN MORE ON OUR SALES FORECASTING SOLUTION

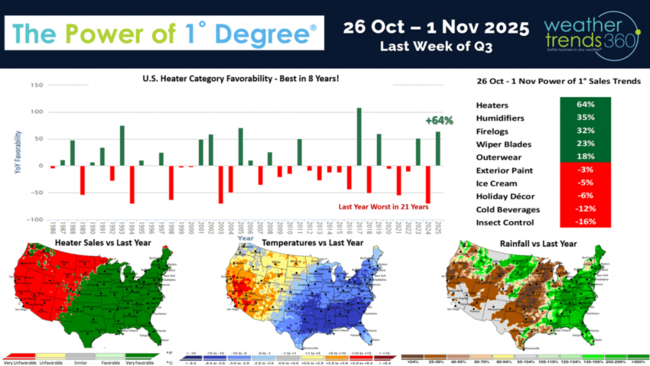

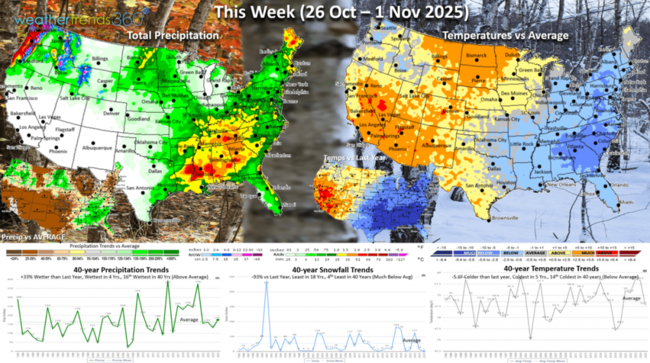

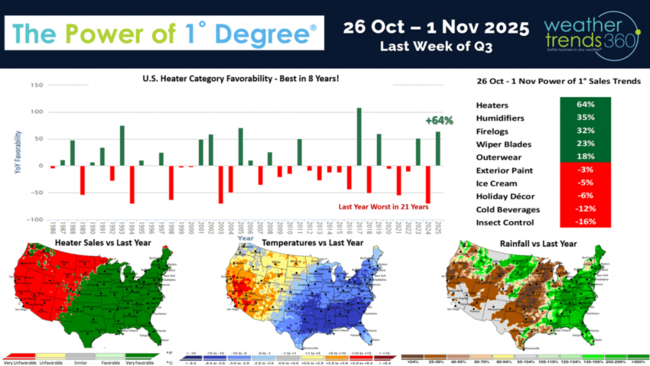

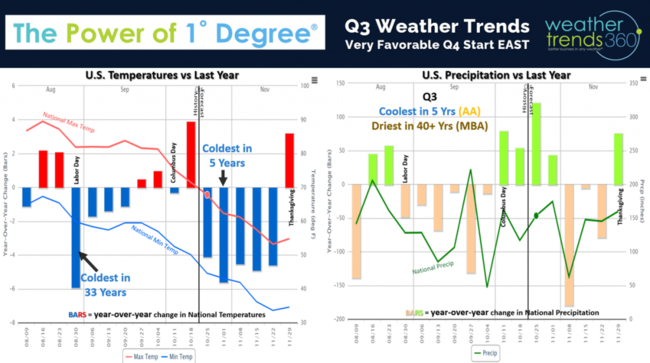

This 26 Oct - 1 Nov period is the last week of Q3 for many retailers and the trends are very strong with a dramatic shift in the weather. U.S. trending the coolest in 5 years with below average national temperatures and the wettest in 4 years. Strong trends for Fall seasonal merchandise sales. Applying the Power of 1F technology we see Heater sales up +64%, Firelogs +32%, Outerwear +18%, but the late summer categories way down. Cold beverages -12% with consumers shifting to hot beverages and insect control down at least -16% vs last year's near record heat.

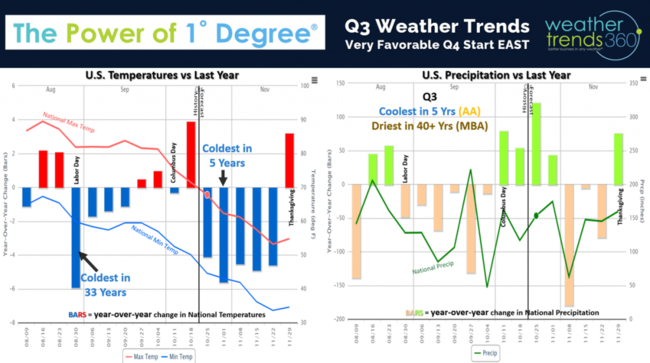

Q3 (Aug - Oct) overall will end up the coolest in 5 years and driest in over 40 years. The Labor Day weekend and now this late October period are the strongest weeks for seasonal sales and overall store traffic. Q4 will get off to a much stronger start with the colder trends (mainly East) which benefits higher margins with reduced needs for markdowns like last year.

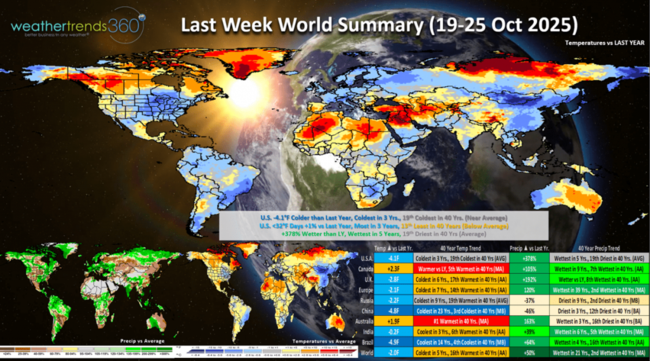

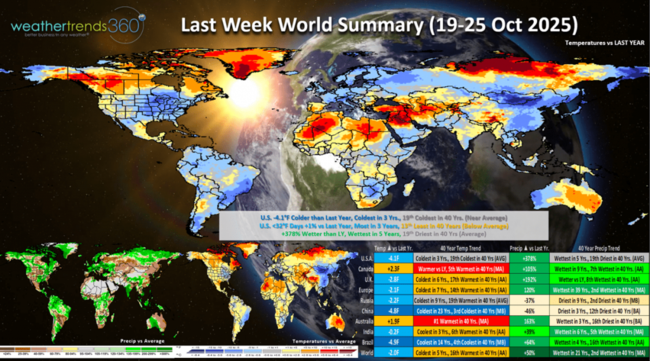

Last week (19-25 Oct) across the World shows the U.S. trending -4.1F colder than last year, coldest in 3 years which led to a bigger uptick in seasonal sales after a soft start to October. Rainfall was up +378% and wettest in 5 years increasing the demand for Fall merchandise and the start of pantry loading for grocery items. Canada was much less favorable while Europe was the coolest in 7 years. This time of year, cooler and drier weather starts to be the most ideal conditions for seasonal sales.

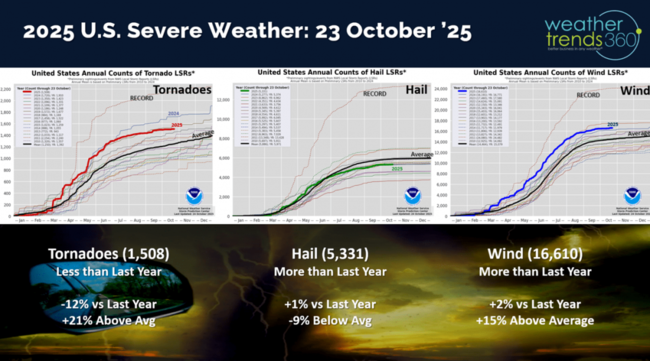

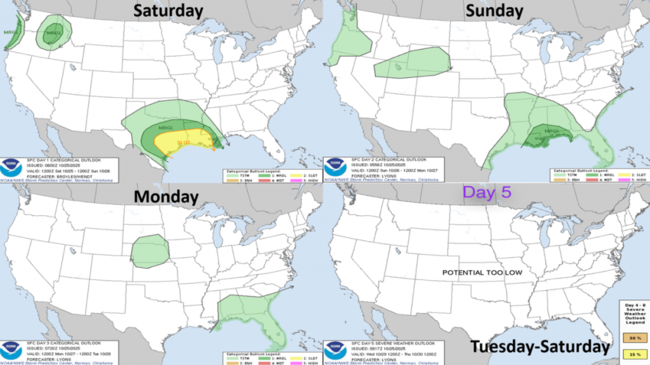

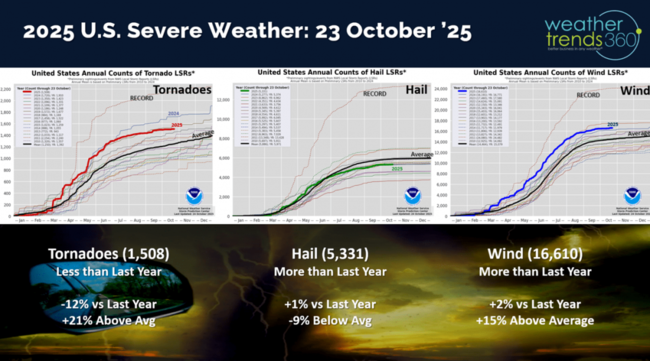

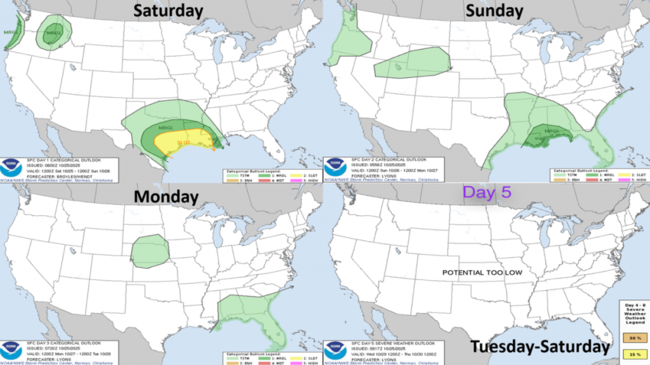

Severe weather is winding down with year-to-date tornadoes down -12% vs LY, hail +1% and wind cases +2% vs a year ago.

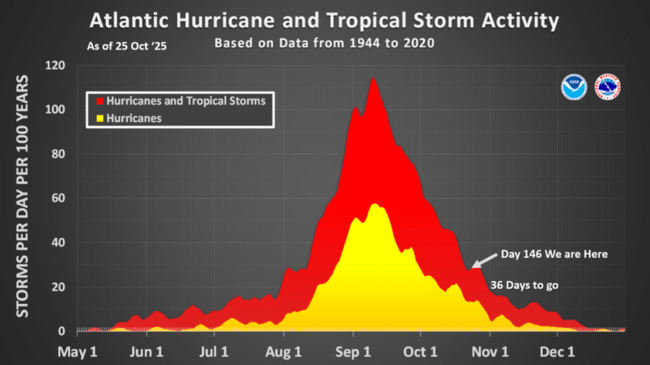

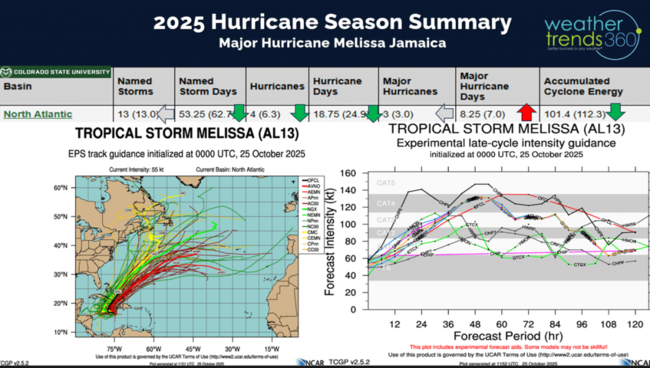

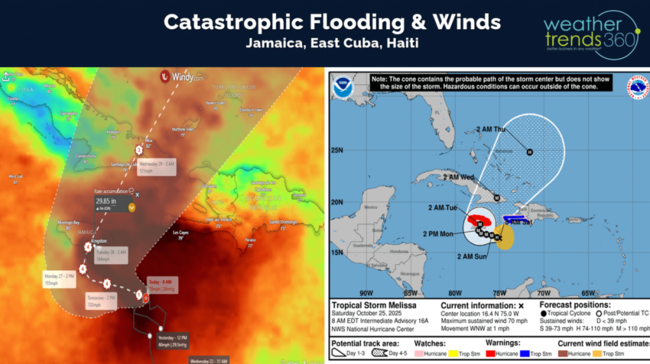

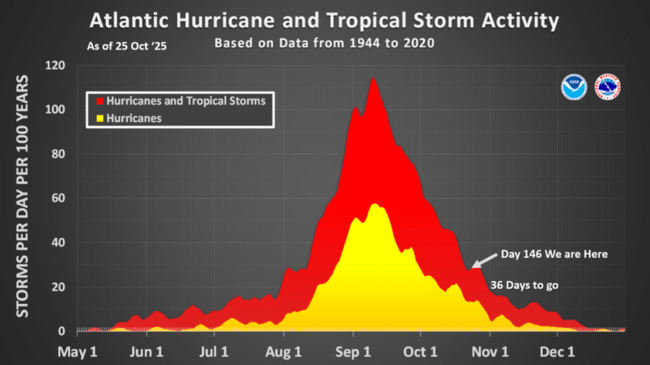

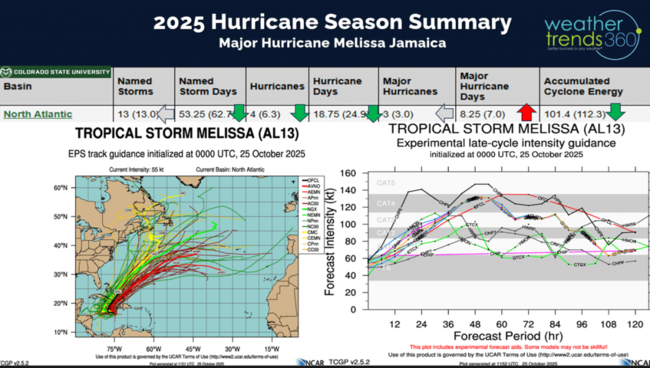

Only 36 days left in the 2025 Hurricane Season, but it's going out with a bang with soon to be major CAT 4 or 5 Hurricane Melissa rapidly intensifying in the Southern Caribbean. The season overall will end up slightly above average.

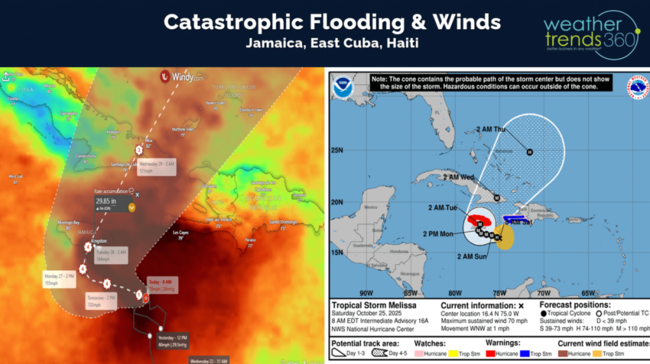

This is another near miss for the U.S. East Coast as a cold front will help to keep Melissa off the Coast with major threats to Jamaica, East Cuba, West Haiti, the Southern Bahamas and eventually Bermuda.

With the exceptionally slow movement of the storm near Jamaica the risk for catastrophic flooding and wind damage is very high; some models show 20-30" of rain around Kingston, Jamaica and two days of hurricane force winds and potential gusts to 150 mph Monday and Tuesday this week.

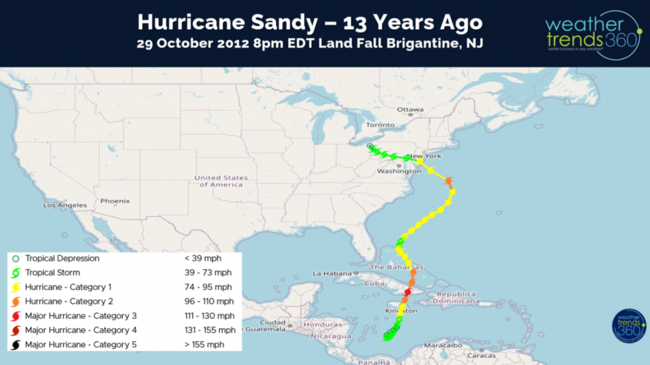

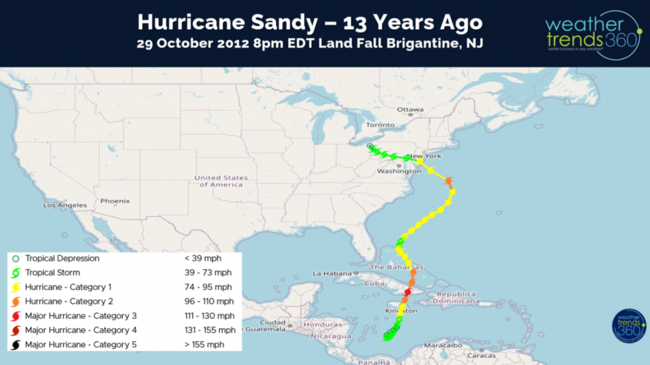

This track, timing and weather pattern setup is eerily similar to Hurricane Sandy in 2012. The saving grace this year is the cold front will be off the East Coast vs inland back in 2012.

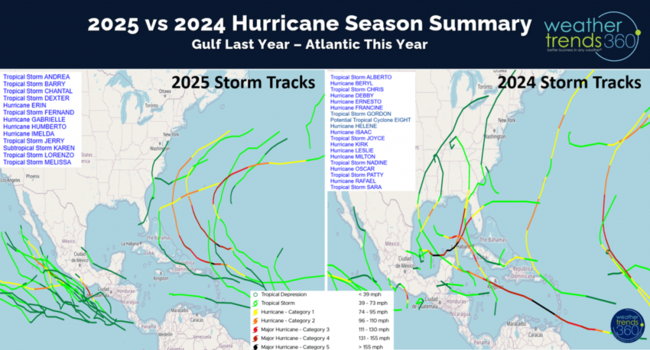

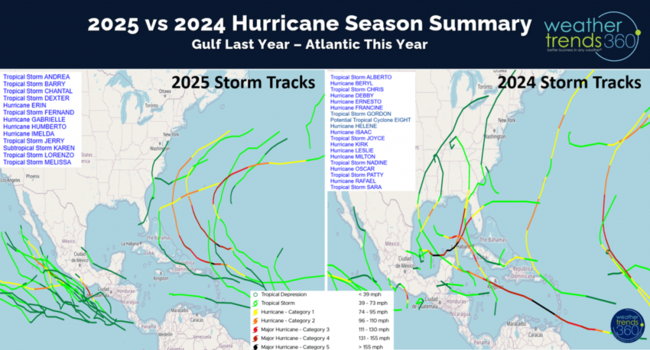

As expected, the 2025 hurricane season was dominated by East Coast to Bermuda tracks vs last year when the Gulf was much more active.

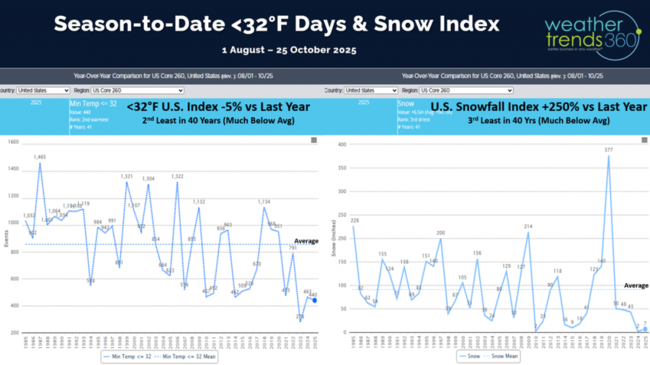

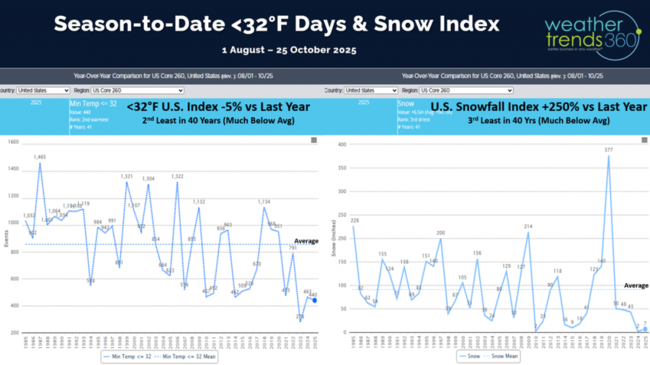

We've started tracking cold and snowy days across the U.S. with our Sub 32F index down -5% vs last year while snow is up +250% vs LY but still 3rd least in 40 years. Both will increase quickly over the next four weeks.

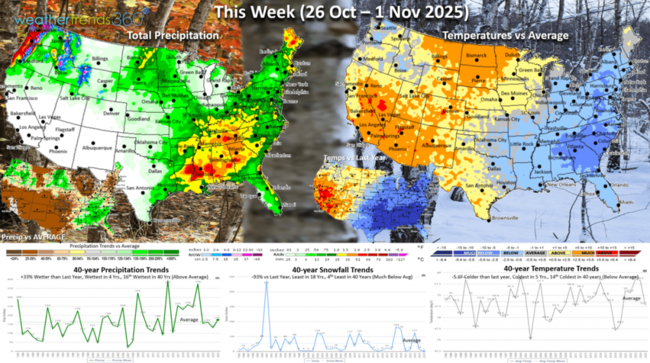

This week (26 Oct - 1 Nov) ends Q3 on a very positive note for the Eastern U.S. with the nation trending -5.6F colder than last year, coldest in 5 years and 14th coldest of the past 40 years. Snow is down but rainfall is up +33% vs last year, most in 4 years and 16th wettest of the past 40 years. The stormy colder weather in the East is a negative for Halloween decor and candy sales but overall, the cold will drive strong seasonal category sales gains and pantry loading. The Western U.S. turns very unfavorable for seasonal items.

Severe weather shows some risks along the Gulf Coast this weekend and then diminishing.

The 6-day snowfall outlook (25-30 Oct) shows continued snow for the higher elevations of the Northwest but not really impacting major population centers with only 3% of the U.S. population impacted.

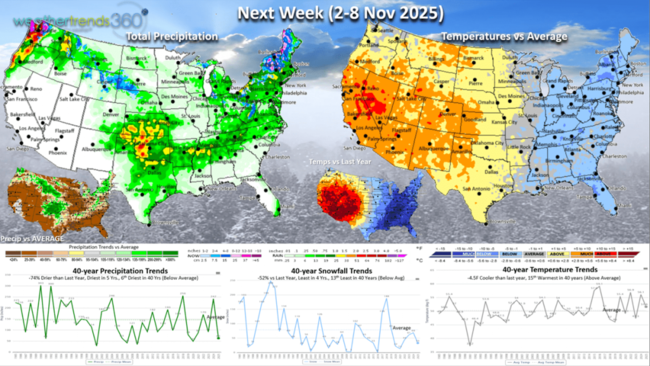

Don't forget to Fall Back next week Sunday (2 November) as Daylight Savings Time ends. Not happy about very early sunsets.

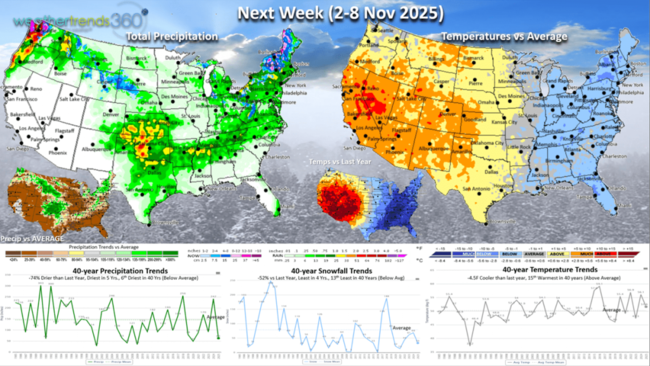

Next week (2-8 Nov) kicks off the start of Q4 and its off to a great start in the East, slow out West. The U.S. overall trends -4.5F colder than last year and 15th warmest in 40 years. The seasons first snow is likely along the Great Lakes and higher elevations of the Northeast. This will keep seasonal sales very strong. Rainfall is down -74% and driest in 5 years which starts to benefit overall store traffic; cooler/drier is the most ideal weather scenario in November.

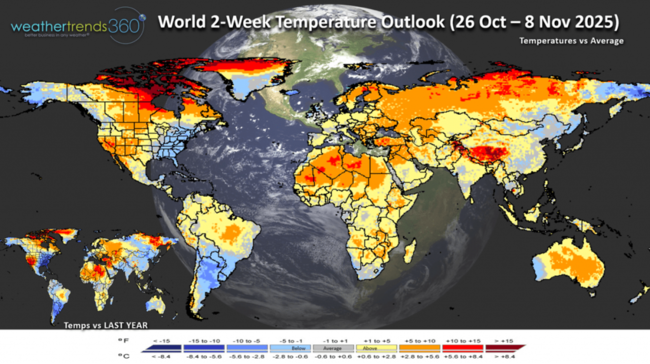

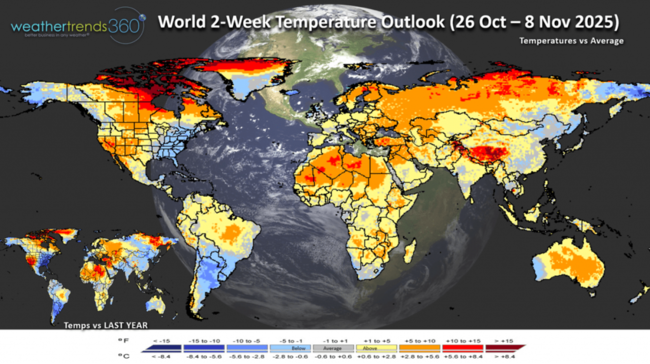

The World 2-week Temperature Outlook (26 Oct - 8 Nov) shows the Eastern U.S., the U.K. and Northeast China areas having the strongest demand for Fall seasonal merchandise.

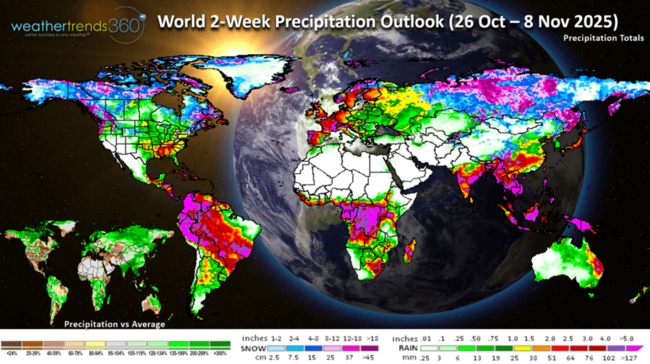

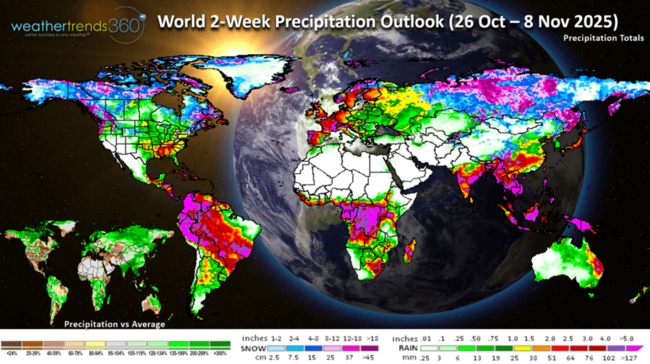

The World 2-week Precipitation Outlook (26 Oct - 8 Nov) shows continued stormy conditions in Europe which can start to slow footfall (store traffic) with a mix of wet and dry in the U.S. Very wet in Brazil will get their Full Season crops off to a great start leading to record yields. This will ultimately be another negative factor for already low Corn prices, negative for farmers, benefit to food suppliers.

Have a great week ahead, and don't forget to follow us on social media for frequent updates: Facebook, Twitter(X), YouTube, Pinterest and Linkedin.

- Captain Kirk out (USAF Gulf War Veteran)

Today let's use the end of Q3 as an example of how our YEAR-AHEAD Power of 1 Degree technology predicts seasonal category sales trends, store traffic, equities and much more. CLICK ON IMAGES FOR A LARGER VIEW.

The process starts by ingesting Point-of-Sale (POS) data by store back several years, builds a correlation model to temperature, rainfall and snowfall to then project those sales out a year by week by store by warehouse anywhere in the World.

Small changes in weather have a significant influence on seasonal sales and consumer buying behavior. Every 1F colder year-over-year, there's a +2% increase in coffee sales, +5% in apparel sales, +7% in mouse trap sales and +10% in portable heater sales. 10F colder YOY the gains are double digits, Coffee +20%, Heaters +100%. LEARN MORE ON OUR SALES FORECASTING SOLUTION

This 26 Oct - 1 Nov period is the last week of Q3 for many retailers and the trends are very strong with a dramatic shift in the weather. U.S. trending the coolest in 5 years with below average national temperatures and the wettest in 4 years. Strong trends for Fall seasonal merchandise sales. Applying the Power of 1F technology we see Heater sales up +64%, Firelogs +32%, Outerwear +18%, but the late summer categories way down. Cold beverages -12% with consumers shifting to hot beverages and insect control down at least -16% vs last year's near record heat.

Q3 (Aug - Oct) overall will end up the coolest in 5 years and driest in over 40 years. The Labor Day weekend and now this late October period are the strongest weeks for seasonal sales and overall store traffic. Q4 will get off to a much stronger start with the colder trends (mainly East) which benefits higher margins with reduced needs for markdowns like last year.

Last week (19-25 Oct) across the World shows the U.S. trending -4.1F colder than last year, coldest in 3 years which led to a bigger uptick in seasonal sales after a soft start to October. Rainfall was up +378% and wettest in 5 years increasing the demand for Fall merchandise and the start of pantry loading for grocery items. Canada was much less favorable while Europe was the coolest in 7 years. This time of year, cooler and drier weather starts to be the most ideal conditions for seasonal sales.

Severe weather is winding down with year-to-date tornadoes down -12% vs LY, hail +1% and wind cases +2% vs a year ago.

Only 36 days left in the 2025 Hurricane Season, but it's going out with a bang with soon to be major CAT 4 or 5 Hurricane Melissa rapidly intensifying in the Southern Caribbean. The season overall will end up slightly above average.

This is another near miss for the U.S. East Coast as a cold front will help to keep Melissa off the Coast with major threats to Jamaica, East Cuba, West Haiti, the Southern Bahamas and eventually Bermuda.

With the exceptionally slow movement of the storm near Jamaica the risk for catastrophic flooding and wind damage is very high; some models show 20-30" of rain around Kingston, Jamaica and two days of hurricane force winds and potential gusts to 150 mph Monday and Tuesday this week.

This track, timing and weather pattern setup is eerily similar to Hurricane Sandy in 2012. The saving grace this year is the cold front will be off the East Coast vs inland back in 2012.

As expected, the 2025 hurricane season was dominated by East Coast to Bermuda tracks vs last year when the Gulf was much more active.

We've started tracking cold and snowy days across the U.S. with our Sub 32F index down -5% vs last year while snow is up +250% vs LY but still 3rd least in 40 years. Both will increase quickly over the next four weeks.

This week (26 Oct - 1 Nov) ends Q3 on a very positive note for the Eastern U.S. with the nation trending -5.6F colder than last year, coldest in 5 years and 14th coldest of the past 40 years. Snow is down but rainfall is up +33% vs last year, most in 4 years and 16th wettest of the past 40 years. The stormy colder weather in the East is a negative for Halloween decor and candy sales but overall, the cold will drive strong seasonal category sales gains and pantry loading. The Western U.S. turns very unfavorable for seasonal items.

Severe weather shows some risks along the Gulf Coast this weekend and then diminishing.

The 6-day snowfall outlook (25-30 Oct) shows continued snow for the higher elevations of the Northwest but not really impacting major population centers with only 3% of the U.S. population impacted.

Don't forget to Fall Back next week Sunday (2 November) as Daylight Savings Time ends. Not happy about very early sunsets.

Next week (2-8 Nov) kicks off the start of Q4 and its off to a great start in the East, slow out West. The U.S. overall trends -4.5F colder than last year and 15th warmest in 40 years. The seasons first snow is likely along the Great Lakes and higher elevations of the Northeast. This will keep seasonal sales very strong. Rainfall is down -74% and driest in 5 years which starts to benefit overall store traffic; cooler/drier is the most ideal weather scenario in November.

The World 2-week Temperature Outlook (26 Oct - 8 Nov) shows the Eastern U.S., the U.K. and Northeast China areas having the strongest demand for Fall seasonal merchandise.

The World 2-week Precipitation Outlook (26 Oct - 8 Nov) shows continued stormy conditions in Europe which can start to slow footfall (store traffic) with a mix of wet and dry in the U.S. Very wet in Brazil will get their Full Season crops off to a great start leading to record yields. This will ultimately be another negative factor for already low Corn prices, negative for farmers, benefit to food suppliers.

Have a great week ahead, and don't forget to follow us on social media for frequent updates: Facebook, Twitter(X), YouTube, Pinterest and Linkedin.

- Captain Kirk out (USAF Gulf War Veteran)