2020 Q1 Weather Forecast for Retail

Monthly Newsletter

As one year closes and a new first quarter emerges, unpredictable weather can pose challenges for business. From volatile temperatures and precipitation to the widespread flu outbreak, it can be difficult to predict what's on the horizon in the new year if you're not properly equipped. Year-ahead weather intelligence makes it easier to turn challenges into opportunities. So, here's our Q1 sales and weather forecasts and a recap of Q4 sales trends to help you start the year out strong.

Q1 Retail Projections

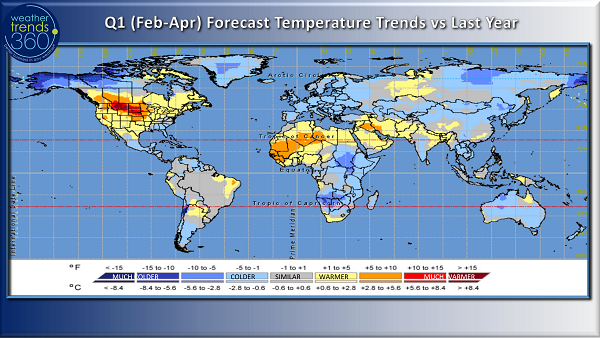

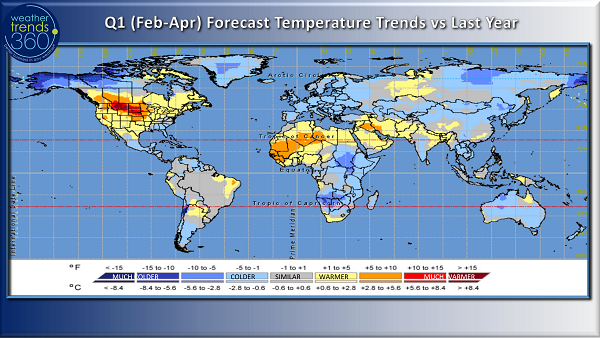

Retail Q1 (Feb - Apr) shows strong, favorable weather for seasonal sales and store traffic. We predict the retail quarter will be the warmest in three years and sixth warmest in 30 years. It will also be the driest in five years and have the least snowfall in three years. Look forward to a strong start to 2020 for seasonal merchandise sales and overall GDP.

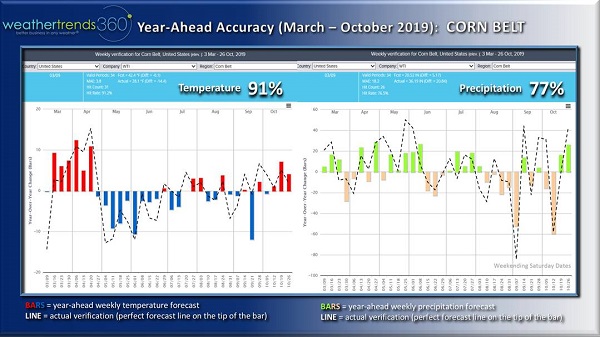

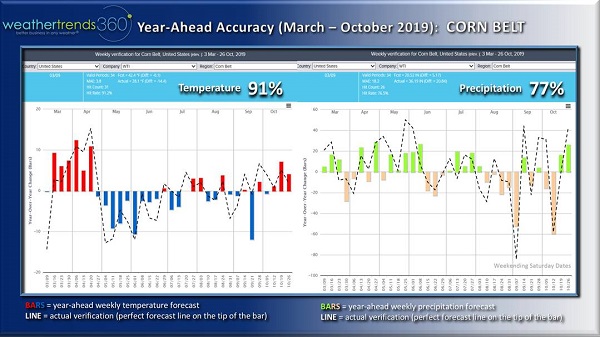

Spring looks like it will get off to a much earlier start in 2020 for much of the U.S. This will benefit almost every sector, including agriculture. The 2019 season was challenging for farmers. Excessive rainfall and cold across the U.S. Corn Belt caused delayed planting. Fortunately, 2020 will be a significantly better start for U.S. farmers, with a much warmer and drier season ahead.

Q4 Weather Recap

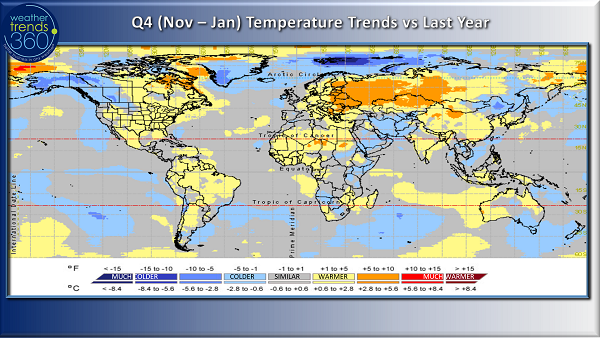

Retail Q4 (3 November 2019 - 1 February 2020) is just about over. As of January 16, the quarter was trending the warmest in three years for the U.S. overall and tenth warmest of the past 30 years. The weeks with the best year-over-year colder trends were week ending November 9 and week ending December 21.

The week before Christmas trended 6.5°F degrees colder than last year, nationally. This resulted in strong demand for winter seasonal merchandise sales. Because every 1°F degree colder increases apparel sales 3%, gains due to weather were about 20%. Fire logs typically show sales gains of 7% for every 1°F degree colder. So, we estimate the weather caused a strong 45% sales increase for a category that typically peaks around Christmas.

An end of quarter surge of cold and snow across the U.S. helped clear out Winter seasonal merchandise before a warm and not so snowy start to January.

Rainfall was down 18% from last year. This helped retail in Q4, as less rainfall means more store traffic. But it was still the eighth wettest period of the past 30 years. Snowfall was up 3% nationally over last year, but still 22% below average and ninth driest in 30 years for the quarter so far.

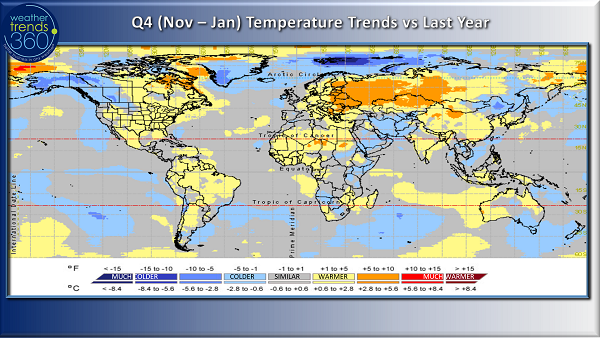

Washington and South Dakota showed the greatest trends toward colder year-over-year conditions. In contrast, the rest of the U.S. trended warmer. In Europe, Spain was the bright spot for more favorable seasonal sales, due to favorable cool weather conditions. Meanwhile, the rest of the continent was generally less favorable with warmer YOY conditions.

The flu had a strong impact on retail in Q4. This season was one of the most widespread early outbreaks since the 2014-2015 season. The flu appears to have peaked in early January - about seven weeks earlier than last season. When consumers are sick, they tend to stay home, but keep shopping. This was a negative for store traffic but a positive for on-line sales.

Conclusion

Planning your business can be challenging if you can't anticipate the weather before it happens. Statistics-based weather intelligence makes it easier to start the year ahead.

Q1 Retail Projections

Retail Q1 (Feb - Apr) shows strong, favorable weather for seasonal sales and store traffic. We predict the retail quarter will be the warmest in three years and sixth warmest in 30 years. It will also be the driest in five years and have the least snowfall in three years. Look forward to a strong start to 2020 for seasonal merchandise sales and overall GDP.

Spring looks like it will get off to a much earlier start in 2020 for much of the U.S. This will benefit almost every sector, including agriculture. The 2019 season was challenging for farmers. Excessive rainfall and cold across the U.S. Corn Belt caused delayed planting. Fortunately, 2020 will be a significantly better start for U.S. farmers, with a much warmer and drier season ahead.

Q4 Weather Recap

Retail Q4 (3 November 2019 - 1 February 2020) is just about over. As of January 16, the quarter was trending the warmest in three years for the U.S. overall and tenth warmest of the past 30 years. The weeks with the best year-over-year colder trends were week ending November 9 and week ending December 21.

The week before Christmas trended 6.5°F degrees colder than last year, nationally. This resulted in strong demand for winter seasonal merchandise sales. Because every 1°F degree colder increases apparel sales 3%, gains due to weather were about 20%. Fire logs typically show sales gains of 7% for every 1°F degree colder. So, we estimate the weather caused a strong 45% sales increase for a category that typically peaks around Christmas.

An end of quarter surge of cold and snow across the U.S. helped clear out Winter seasonal merchandise before a warm and not so snowy start to January.

Rainfall was down 18% from last year. This helped retail in Q4, as less rainfall means more store traffic. But it was still the eighth wettest period of the past 30 years. Snowfall was up 3% nationally over last year, but still 22% below average and ninth driest in 30 years for the quarter so far.

Washington and South Dakota showed the greatest trends toward colder year-over-year conditions. In contrast, the rest of the U.S. trended warmer. In Europe, Spain was the bright spot for more favorable seasonal sales, due to favorable cool weather conditions. Meanwhile, the rest of the continent was generally less favorable with warmer YOY conditions.

The flu had a strong impact on retail in Q4. This season was one of the most widespread early outbreaks since the 2014-2015 season. The flu appears to have peaked in early January - about seven weeks earlier than last season. When consumers are sick, they tend to stay home, but keep shopping. This was a negative for store traffic but a positive for on-line sales.

Conclusion

Planning your business can be challenging if you can't anticipate the weather before it happens. Statistics-based weather intelligence makes it easier to start the year ahead.